Publication: DNA, Mumbai; Date: January 16, 2007; Section: Personal Finance; Page: 6

The net yield on them is not very impressive

Insurance companies have for long played on our fear of old age and sold so-called pension plans to us. But, are these plans the right choice?

Insurance companies have for long played on our fear of old age and sold so-called pension plans to us. But, are these plans the right choice?

Pension plans can be largely divided into two categories: immediate annuities and deferred annuities. An immediate annuity is an actual pension plan, which keeps the sanctity of the word pension in tact. On putting money in an immediate annuity, the insurance company pays the policy holder a certain sum of money at yearly or other regular intervals (monthly , quarterly or semi annually).

On the other hand, deferred annuity, has two main phases — the savings phase in which the premium paid is invested and the income phase in which the corpus that has been accumulated in the savings phase can be utilised to buy an immediate annuity. Though deferred annuities are mostly sold as pension plans and tax-saving devices, for long term financial health, they are best ignored.

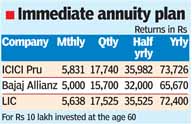

There are just 3 immediate annuities in the Indian market. These are Jeevan Akshay-V from the Life Insurance Corporation of India, Immediate Annuity from ICICI Prudential and Swarna Raksha ROC from Bajaj Allianz.

Even immediate annuities may not be the best way to generate an income out of the corpus that has been accumulated. For eg, Rs 10 lakh invested in Swarna Raksha at age 60 will give Rs 65,670 per annum (See table). This means a return of around 6.56% per annum. This is payment guaranteed for life. In case the policy holder expires, the Rs 10 lakh is returned to his or her nominee.

Remember that your monthly payouts are taxed as income in your hands according to the tax bracket you fall into. So, if you fall in the 30% tax bracket, the net yield for the Bajaj product is 4.60% and that of LIC is 5.07%. The net yield on the immediate annuity of ICICI Prudential is a little better at 5.16%.

Now, instead of taking an immediate annuity policy, lets see why opting for Post Office Senior Citizens Savings Scheme is a more sensible decision. The scheme provides an interest of 9% per annum which is paid out at quarterly intervals. The interest is not tax free. For individuals falling in the 30% tax bracket, the net yield works out to be 6.3%, much better than any of the immediate annuities on offer. The maximum amount that can be invested in this scheme is Rs 15 lakh.

Now, instead of taking an immediate annuity policy, lets see why opting for Post Office Senior Citizens Savings Scheme is a more sensible decision. The scheme provides an interest of 9% per annum which is paid out at quarterly intervals. The interest is not tax free. For individuals falling in the 30% tax bracket, the net yield works out to be 6.3%, much better than any of the immediate annuities on offer. The maximum amount that can be invested in this scheme is Rs 15 lakh.

There is also the Post Office Monthly Income Scheme which pays an interest of 8% per annum, with interest being paid out monthly. The maximum investment allowed in this scheme is Rs 3 lakh.

An individual should exhaust the limits of these schemes before looking to put his money in an immediate annuity. Further, these days even bank fixed deposits are giving better returns than immediate annuities. Even though the income from all these products is taxable, the net return works out to be much better than those of immediate annuities.

Thus, people in the accumulation phase (age group of 22-55) should exclude both immediate and deferred annuities from their portfolio.

The size of the pension that an individual gets from an immediate annuity depends on the following factors:

Amount invested in the immediate annuity. It need not be said that greater the amount invested, greater is the pension.

Payout mode. Monthly, quarterly, semi annually or annually. The payout is lowest for the monthly mode and highest for the annual mode.

Life expectancy. Payout depends on your current age and hence, if you opt for it at age 55, payout will be lesser than if you opt for the pension plan at 60.

Payout options and whether payments continue after your death.

To read the original article click here