This is one stock market, fortune-telling, goof-up that has the potential to trend on Twitter as an #EpicFail

Somewhere in August 2000, Fortune Magazine came up with a buy-and-forget portfolio for investors who were looking to retire in 2010. The promise was “If you’re a long-term investor, these 10 should put your retirement account in good stead and protect you from those recurring nightmares about the stocks that got away…”

So how did these stocks really fare over the next 10 years? Talk about hitting the bottom.

All but one of the “stocks for the decade” not only lost money, but also underperformed benchmarks. Only one single stock outperformed an appropriate benchmark, two went bankrupt, and the average pick lost 31 percent.

We are continuously bombarded with tips and recommendations of ‘must-have’ stocks. Speculations and expert predictions are published every day for the investor’s ‘benefit’. There is so much noise all around that it is easy to get influenced.

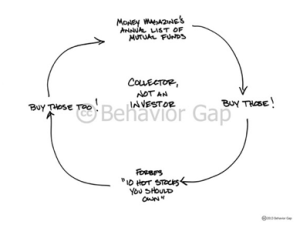

So how do you ‘behave’ in the face of this media blitz. This is where Carl Richards’ advice (behaviorgap.com) gets very relevant.

Think of each investment that you own as a thread in a larger tapestry. You shouldn’t buy individual investments because they appear on the cover of a financial magazine. You buy investments for what they contribute to your overall portfolio. It’s the overall portfolio that’s important and not the individual investments.

Remember: you’re not a collector, but an investor. You want stocks (or funds) that get you closer to the financial goals you’ve set for yourself. You also need to make sure that what you own doesn’t expose you to greater risk than you can handle, again based on your goals. The end result should be a portfolio that reflects your goals, not a collection of magazine covers.

Moral of the story : Stop behaving like a Collector and start behaving like an Investor !

Did you find this piece helpful? We thrive on your feedback and are always eager to hear and learn from you. Look forward to your comments.