Of all the ‘laymen’ explanations on inflation that I have read over the years, this has been the most interesting. In a 2008 article, master investor, Ajit Dayal, explains inflation in simple samosa terms.

In 1980, it probably cost you Re 1 to buy one samosa. Today, it costs you Rs 10. Has the samosa become 10 times larger over the past 27 years? Not at all. The fact is that Indian rupee has lost value over the past 27 years so the samosawallah wants more of your rupee to sell you the same samosa.He wants 10 times the rupees for that same samosa. Or look at the price of your house. In 1980, it cost Rs 200 to buy one square foot of property in Cuffe Parade, Bombay. Today, it costs Rs. 40,000 per square foot. That is an increase of 200 times! Money, obviously, buys less these days. Paper money has lost value. That is what is called “inflation”.

Inflation is the blind spot, that causes most investment accidents. It is the costly overlook due to which investors often miss the mark. By a mile. Consider this. All planning and budgeting have a very long-term outlook: be it college education for our kids, retirement allocation for you and your spouse, or planning for contingency health-care expenses. They will occur many years in the future. All the more reason to constantly and correctly adjust for inflation.

Some investors forget to adjust for inflation – probably in the hope of the perpetuity 1-rupee Samosa offer. Others take an arbitrary estimate of inflation, while most use the government released inflation numbers (WPI / CPI, etc.)

The point is also that the rate of inflation for a particular commodity / service, cannot be an arbitrary number. For example think about the following in terms of their costs today compared to 10-years ago:

- A vacation abroad ?? Leisure inflation – anywhere around 15-20%

- A movie ticket ?? Entertainment inflation – anywhere around 16-18%

- A knee-replacement procedure ?? Healthcare inflation – anywhere around 12-15%

- An MBA Degree ?? Education inflation – upwards of 10-12%

- The cost of Petrol !!! Fuel inflation – upwards of 8-10% and so on …

Now if you were applying an arbitrary number of say a 7.72% (some WPI data) you can see how far off would you be if any of the above (the knee-replacement as a medical contingency goal, of-course) was a long-term goal. Since your guess is as good as mine, the idea is to improve the guessing process.

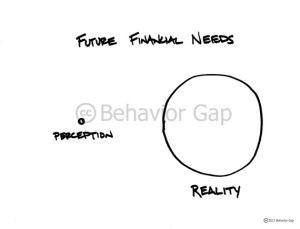

As Carl Richards (behaviorgap.com) writes:

For almost every other financial goal that is years away, it’s important to understand that things will change. No matter how much time we spend creating a plan it can’t capture everything about our future reality. All we’re trying to do is make the best guess we can and move on. If you understand that these are guesses (very important guesses), then you can give yourself permission to not obsess over them. Make the best guess you can with the information you have, and then commit to revisit it often enough to make course corrections long before you veer too far off course.The other wonderful thing that will happen is that often we find out that even though our perception of our future financial needs was not even close to reality, we gain a sense of control that helps us focus on living our lives NOW. In many cases, we learn that we do have enough money and time to meet our goals. It might not even be a situation of needing to grit our teeth and save more, but we never know until we take the time to plan!

So the idea for the month is to keep your eye on the cost of the samosa (being a foodie I know I am risking ridicule by saying this but so be it).

- Plan and put down your goals on a piece of paper.

- Get obsessed with your goals.

- Keep a hawkish eye on the cost of your goal year on year.

- Be agile and course correct so that there are no nasty surprises when the goals do come up.

Did you find this piece helpful? We thrive on your feedback and are always eager to hear and learn from you. Look forward to your comments.

Team MFA