Don’t we all just love Carl Richards !!

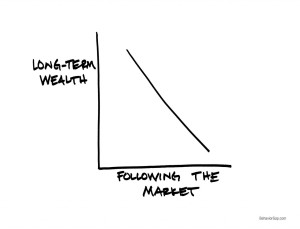

As an expert in the field of Financial Planning, Carl has done a huge favor to the entire investor fraternity by simplifying a knotty (yet crucial) subject: Behavioral Finance and turned it into powerful, simple to understand ‘Napkin Sketches’ in his best-selling book:

The sophistication of his work is in its Simplicity. You have to read it to believe it.

Here, we bring to you a small piece authored by him. We have Indianised the content to make sure that you do not miss the message. We are sure, Carl won’t mind that.

http://store.behaviorgap.com/long-term-wealth/

Adapted from the original article: Does 14,000 Actually Mean Anything?

When the Sensex hit 19,000, the questions started flying. Do I buy? Do I sell?

But the question that really matters is, “How can we avoid making the big behavioral mistake of selling low and buying high (again!) in the future?”

It’s a question that’s generated an interesting conversation, which got me thinking about something that’s probably tripped up each of us once or twice:anchoring.

Now in the past, when I’ve talked about anchoring, I’ve focused on the idea of holding on to an asset (e.g., your home, a stock, etc.) because you have a number fixed in your head. I think we’re seeing another type of anchoring with all this chatter around the Sensex hitting 20,000.

It seems as though we look at that nice, round number, and it triggers a reaction. Clearly it’s a sign that we should change our investing strategy, right? 20,000 must mean something. It has to! And maybe it does, but only if you previously put a line in your financial plan that ties some decision or action to that number. If you didn’t, then it’s most likely just a number.

And that’s a hard idea for people to accept when they see supposedly important (Urgent! Must act now.) numbers plastered across magazine covers and CNBC. It seems like we lose our collective minds when we start talking about these numbers.

So the next time the hysteria hits (We’re going to 21,000!) or you’re still suffering a hangover from this go around, I want you to think about a couple of things:

- The Sensex is a stock market index of only 30 stocks, not the entire stock market. Unless you only own those 30 stocks, it seems a little silly to base your financial decisions solely on what the Sensex is or isn’t doing.

- Numbers matter, but you need to pay attention to the ones you have some hope of controlling. How much are you saving? How much are you spending? These are numbers that matter.

I know it’s hard to ignore the hype, and you’re tempted to focus on the number. But whether it’s the Sensex or the value of your home, the numbers will rarely mean what you think they do.

Carl