Publication: DNA,Mumbai; Date: August 4, 2007; Section: Personal Finance; Page: 6

LICs Market Plus is a losing proposition

Life Insurance Corporation of India (LIC) launched unit linked insurance plans (Ulips) much later than its private sector counterparts. And though these products have been in vogue for around five years, the insurance behemoth has only two Ulips as on date, one of which is Market Plus, a deferred pension Ulip.

Life Insurance Corporation of India (LIC) launched unit linked insurance plans (Ulips) much later than its private sector counterparts. And though these products have been in vogue for around five years, the insurance behemoth has only two Ulips as on date, one of which is Market Plus, a deferred pension Ulip.

The Webster dictionary defines pension as “a fixed sum paid regularly, especially to a person retired from service.”

In the Indian context, pension plans can be divided into two categories: immediate annuities and deferred annuities. An immediate annuity is an actual pension plan that keeps the sanctity of the word pension intact. On putting money in an immediate annuity, the insurance firm pays the policyholder a certain sum of money at yearly or other regular intervals (monthly, quarterly, semi-annually or annually). On the other hand, deferred annuity has two main phases, the savings phase in which the premium paid is invested, and the income phase in which the corpus that is accumulated in the savings phase can be utilised to buy an immediate annuity. In a nutshell, they are accumulation instruments carrying the misleading tag “pension.”

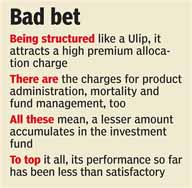

LICs Market Plus fits into the second category, but for the fact that it is structured like an Ulip and hence attracts a high premium allocation charge. Premium allocation charge is the percentage of the premium appropriated as charges from the premium received. The balance, known as the allocation rate, is utilised to purchase units for the policy. Allocation charges for single premium policies are 3.3% and for regular premium policies between 13.50% and 16.50%, depending on the premium paid. Lets say you pay a regular premium of Rs 1 lakh. The premium allocation charge of around 15.75% will ensure that only Rs 84,250 is utilised to buy units in any of 4 types of funds — Bond Fund, Secured Fund, Balanced Fund and Growth Fund. The money invested accumulates in an investment fund.

Besides the premium allocation charge, there are product administration charges, mortality charges and fund management charges like in other Ulips.

Benefits of the policy

Death benefit:

Under this plan, the policyholder can opt for a life cover of certain sum assured. In the event of his death, this sum assured along with the value of the investment fund would be paid to the nominee either as a lump sum or as pension. Let us say a person takes a cover of Rs 10 lakh with a premium of Rs 84,000 per annum and dies after 2 years of premium payment. His family will receive Rs 10 lakh plus the amount accumulated in his investment account.

In case the policy is taken without life cover, the investment fund shall be payable either as a lump sum or as pension. The amount of pension will depend on the prevailing immediate annuity rates under the annuity option chosen. Other than life cover, the policyholder has the option of taking an accident benefit cover equal to life cover subject to a minimum Rs 25,000 and maximum Rs 50 lakh (including all policies with LIC and other insurers). In case of death by accident, an additional sum equal to the accident benefit will be payable.

In case the policy is taken without life cover, the investment fund shall be payable either as a lump sum or as pension. The amount of pension will depend on the prevailing immediate annuity rates under the annuity option chosen. Other than life cover, the policyholder has the option of taking an accident benefit cover equal to life cover subject to a minimum Rs 25,000 and maximum Rs 50 lakh (including all policies with LIC and other insurers). In case of death by accident, an additional sum equal to the accident benefit will be payable.

Benefit on vesting

If the policyholder survives the period of the policy, the investment fund will compulsorily be utilised to provide a pension based on the then prevailing immediate annuity rates under the relevant annuity option. However, you may opt for one-third of the benefit to be paid out in a lump sum. Also the policyholder has the option of purchasing an immediate annuity either from LIC or any other life insurance company that offers it.

Points to remember:

Conversion to annuity at vesting date: Once the policy matures, it gets converted into an immediate annuity. The rate at which it will be converted to an annuity is not guaranteed and will be based on the prevailing immediate annuity rates under the relevant annuity option at the vesting date.

Surrender policy

There is no surrender charge in this policy. However, if you surrender the policy before the end of the third year, the surrender value is only paid to you after completion of 3 policy years.

Performance of the scheme

The schemes performance has been less than satisfactory (see table) and when clubbed with high initial expenses, is a losing proposition for policyholders.

Should you opt for it?

When you buy any insurance policy or pension plan, look at what your objectives for doing so are. Is it life insurance or a pension every month during retirement? The key thing to be kept in mind is that deferred pension products are just used to accumulate a corpus. Accumulation is something that can be addressed through several other cost and tax effective means. If the whole idea is to accumulate a corpus, you might as well do it through PPF, EPF, fixed maturity plans, real estate or equity, and buy a real pension plan only if you need one post-retirement. This plan compels you to buy an immediate annuity with 100% of your corpus or 66.66% of your corpus (if you take a third as a lump sum payout). Why go for such a product now when you can buy one during retirement if necessary?

The author runs My Financial Advisor and can be reached at amar.pandit@myfinad.com.

To read the original article click here