Publication: DNA, Mumbai; Date: July 21, 2009; Section: Personal Finance; Page: 6

LICs Jeevan Amrit endowment plan may be asking for too much

Endowment plans generally have very long premium paying tenures. But, Jeevan Amrit from the Life Insurance Corporation (LIC) offers covers for terms of 10-30 years, where a policyholder is required to pay a premium for just 3, 4 or 5 years.

Endowment plans generally have very long premium paying tenures. But, Jeevan Amrit from the Life Insurance Corporation (LIC) offers covers for terms of 10-30 years, where a policyholder is required to pay a premium for just 3, 4 or 5 years.

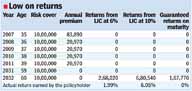

The endowment assurance plan is clearly aimed at those who do not want the bother of having to pay premiums over a longer duration. The premium payable during the first year is higher than the premiums payable in subsequent years. For example, if you opt for a cover of Rs 10 lakh for 25 years at the age of 35 (see table), and take a 5-year premium schedule, the premium paid in the first year is Rs 83,890 and Rs 20,970 per year during the remaining four years, which adds up to Rs 1,67,770. In years 6-25 no premium needs to be paid.

The endowment assurance plan is clearly aimed at those who do not want the bother of having to pay premiums over a longer duration. The premium payable during the first year is higher than the premiums payable in subsequent years. For example, if you opt for a cover of Rs 10 lakh for 25 years at the age of 35 (see table), and take a 5-year premium schedule, the premium paid in the first year is Rs 83,890 and Rs 20,970 per year during the remaining four years, which adds up to Rs 1,67,770. In years 6-25 no premium needs to be paid.

Sounds attractive? Dont jump in yet. Let us first sample the “benefits” it offers.

Death benefit:

Like any other endowment policy, the sum assured (i.e., the life cover the individual taking the policy opts for), along with vested simple reversionary bonuses and final (additional) bonus, if any, is payable immediately on death of the policyholder during the term of the policy. Lets say the policyholder with a sum assured of Rs 10 lakh dies 5 years after taking this policy. His family would receive Rs 10 lakh + any annual bonus + any final bonus. Mark the emphasis on the word if any.

Maturity benefit:

Once the policy matures, the total premiums that you have paid (excluding extra premiums, if any) are paid along with vested reversionary bonuses and final (additional) bonus, if any, in case of the policyholder surviving till the end of the term.

Surrender value:

Unlike other insurance policies, which can be surrendered after 3 years, the policy can be surrendered after completion of at least one policy year, provided premiums for one full year have been paid. However, the surrender value, like in the other policies, is 30% of the premiums paid, excluding extra premium, if any. Additionally, the cash value of any existing vested bonuses will also be paid.

Actual returns

As per the table, if LIC earns 6% returns on the premiums paid, the actual return earned by the policyholder is only 1.99%. The difference is primarily because of the policy expenses. Similarly, if LIC earns a 10% return, then the actual return earned by the policyholder is 6.05%, which is also rather low.

All the same, these returns are mere illustrations and if there are no profits, only the premiums paid would be returned on maturity. You might take solace from the fact, though, that at least the premium amount is guaranteed.

Is it worth buying?

As the table shows, the first-year premium is an exorbitant sum and the returns are abysmally low. Going by the bonuses declared by LIC in the past, the returns might at most be in the range of 4-6%, including both yearly and final bonuses, which barely meets the rate of inflation. And someone who is able to cough up that much money in a single year would certainly have better investment avenues.

As for insurance, the premium for a term insurance plan of Rs 10 lakh from LIC itself would be around Rs 5,500 per year, or Rs 1,37,500 over 25 years – way less than what you pay in Jeevan Amrit.

Some people might argue that even with a 0% return, one is at least assured of getting back his premium amount in this plan, unlike in a term plan. But, they must remember that it neither helps them get adequate cover, nor meets their investment needs.

In fact, industry sources are quick to point out that the product may have been inspired by the mis-selling associated with unit linked insurance plans, wherein insurance agents generally lure customers in with the claim that they have to pay premiums only for the first three years. Heres an endowment product instead, where you can be done with paying premiums in three years, too!

Like we have always maintained, one must do a thorough needs analysis and take a sizeable cover, accounting for his liabilities, childrens education, any capital requirement and family income needs.

For people in the middle income group, the ideal cover may be Rs 50 lakh or more. In case of Jeevan Amrit, a Rs 50 lakh cover would be around Rs 4.2 lakh (present value) in the first year and Rs 1.05 lakh per year in years 2-5. For a term plan of similar cover, the annual premium would be Rs 27,671. Which one would you pick?

To read the original article click here