Publication: DNA, Mumbai; Date: June 1, 20087 Section: Personal Finance; Page: 6

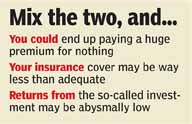

Also, it should not be clubbed with investment

“How is LICs Retired Life Policy?” asked one of my acquaintances a few months back. “There is no such product by LIC,” I replied. But, he insisted that there was such a policy and that he had bought it by paying a premium of Rs.2.5 lakh. This made me curious and I asked him to show me the illustrations and policy documents.

“How is LICs Retired Life Policy?” asked one of my acquaintances a few months back. “There is no such product by LIC,” I replied. But, he insisted that there was such a policy and that he had bought it by paying a premium of Rs.2.5 lakh. This made me curious and I asked him to show me the illustrations and policy documents.

I read the illustration and told him that the disclaimer on the last page clearly said that this was not a LIC product and that it was a combination of separate LIC plans. The plans he was buying were endowment plans with different maturity dates. A closer inspection of the policies bought by this acquaintance revealed that these different

policies were for periods from 25 to 35 years. For a cover of Rs 75 lakh, this gentlemans wife had 25 policies of Rs 3 lakh each and was roughly paying a premium of Rs.2 lakh per annum. The fact that the illustration carried a different name does not mean anything and that returns from such products would be the same if he had just bought 1 endowment plan instead of 30 with the so called “retired life” policy.

The average bonuses of LIC endowment plans for 2005-2006 (as per the data on their website) were between Rs 31 and Rs 46 per thousand. This means a return of 3.1% to 4.6% per annum. This bonus depends on the term of the policy and is higher for higher term policies. In addition to this, there are final bonuses on maturity of the policy. This final bonus would again be based on the premium paying term, plan and sum assured of the policy. The final bonus, along with the bonuses declared every year, would ensure a return of around 5% to 6 % per annum for most of the endowment plans. The best part is that these returns are not compounded and so the total returns often turn out to be much lower.

So, the plans that this acquaintance of mine had were plans that would return 5 to 6 % per annum. He was confused and shocked, in that order, when I ran the numbers.

It was shown on the illustration that the premiums had to be paid directly for only 25 years. This was converted into a selling point by the insurance agent by telling my acquaintance that you would need to pay premiums only for 25 years and have a cover for a greater period of time. That, though, was really not the case. The policies were structured like a bond ladder of different maturities; and the last premium was to be paid till the 35th year. What was effectively happening was that the policy that would mature in year 25 would be used to pay premium for other policies and so on. Effectively, this gentleman paid a premium of close to Rs 66 lakh and would get approximately Rs 12.5 lakh every year after 25 years. In total, he would receive Rs 2.6 crore on maturity. This was calculated by taking the bonus declared for year ending March 31, 2006.

It was shown on the illustration that the premiums had to be paid directly for only 25 years. This was converted into a selling point by the insurance agent by telling my acquaintance that you would need to pay premiums only for 25 years and have a cover for a greater period of time. That, though, was really not the case. The policies were structured like a bond ladder of different maturities; and the last premium was to be paid till the 35th year. What was effectively happening was that the policy that would mature in year 25 would be used to pay premium for other policies and so on. Effectively, this gentleman paid a premium of close to Rs 66 lakh and would get approximately Rs 12.5 lakh every year after 25 years. In total, he would receive Rs 2.6 crore on maturity. This was calculated by taking the bonus declared for year ending March 31, 2006.

For the insurance agent, it made perfect sense to sell 25 polices of Rs 3 lakh each vis-à-vis one policy of Rs 75 lakh, as by selling policies of varying maturities, the insurance runs for a longer period and the insurance agent makes a greater commission.

Now, lets see how it would work out if this gentleman separated his insurance and investment needs. A term plan with a sum assured of Rs 75 lakh would require a premium of Rs 15,800. To service all the existing policies, my acquaintance was already paying a premium of around Rs 2 lakh per annum. This means, the difference of premium (Rs. 2 lakh – Rs. 15800 = Rs 1,84,200) could have been invested separately every year, if he chose to meet the insurance cover through his term plan. Invested in a combination of Public Provident Fund and Voluntary Provident Fund for the same period, this amount would have fetched a compounded return of 8% (VPF now is 8.5%). If we assume 7% compounded returns, the corpus would have been much more than in such policies.

And had he opted for mutual funds and stocks and earned a return of around 12%, he would have at least 2-3 times more money.

On top of this, the policies were backdated. This is yet another common selling method followed by LIC agents. In backdating, a policy is shown as issued several months ago so that an individual can get the policy at a slightly cheaper rate. If an individual is a year younger, the premium tends to be a little low. But, individuals should refrain from backdating and here is why:

When a policy is backdated

You are essentially paying a premium for a cover which did not exist or which you have not utilised. For example, if you buy a policy today but backdate the policy and its shown that the policy was bought in October 2006, you have essentially paid premium for the period October 2006 to May 2007 for which you had no cover at all from LIC.

You will have to pay the second premium in October 2007. So, essentially you are paying the first premium in May and the second in October. So, within 6 months, you have paid 2 years worth of premium.

Thirdly, the difference in premium is not much when you are young. In this case, the premium is almost the same at 25 or 26, without so much as a rupees difference.

The free-look period of 15 days is over in October itself. So, even if you want to cancel the policy now, you cannot because it is shown that the policy has been bought in October.

So, before you fall for such pitches, understand the nuances of such policies. Fancy names dont matter. What should matter is getting a sizeable cover at a reasonable premium. To that effect, nothing works like a term plan.

amar.pandit@myfinad.com

To read the original article click here