Publication: DNA; Date: June 26, 2006; Section: Personal Finance; Page: 24

Asset allocation is the most important decision that an investor must make to achieve his financial goals and effectively manage risk. In simple terms, asset allocation is spreading your money across a mix of asset classes, namely bonds, real estate, equity (direct stocks, mutual funds), gold and cash.

Asset allocation is the most important decision that an investor must make to achieve his financial goals and effectively manage risk. In simple terms, asset allocation is spreading your money across a mix of asset classes, namely bonds, real estate, equity (direct stocks, mutual funds), gold and cash.

Recently I met Rakesh Sharma, a 44-year-old corporate executive, who wanted to get his financial plan done. I asked him: “What, according to you, is probably the most important decision you can make as an investor in achieving your financial goals while effectively managing risk?”

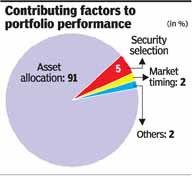

“It has to be selection of products/ securities or getting into and out of the market at the right time,” he replied.

“It has to be selection of products/ securities or getting into and out of the market at the right time,” he replied.

I realised that he was way off track and didnt know about the concept of asset allocation.

Sharma was a fitness freak. Thus, I thought that the best way to explain and drill the importance of asset allocation was to use an analogy from the fitness world.

“If the mantra to great health is eating healthy — a balanced diet with the right mix of essential proteins, carbohydrates, minerals, vitamins and, of course, proper workout, then the mantra to great wealth would be in having a right asset allocation – a balanced mix of various investments like bonds, real estate, equities, gold.”

“In fact, without asset allocation, every investor is exposed to various risks such as losing purchasing power, market risk (when you create an all-equity portfolio), etc. Additionally, without asset allocation, the decisions to add products to a portfolio are done in an ad-hoc manner, based on the return expectations alone,” I said.

Studies show that a portfolios asset strategy is the driving force behind portfolio performance. And, over a period of time, it accounts for more than 90% of the variation in overall returns.

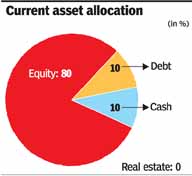

Sharma had 80% of his portfolio in equities, 10% in cash and 10% in debt. He enjoyed some fantastic returns in the last three years and was little apprehensive on the need to tune it up. However, after the recent correction in the markets, he thought it would be wise to restructure his portfolio.

I told him that he should invest in different assets, based on his tolerance and capacity to take risks, investment time horizon, liquidity and returns needed to achieve the goals.

We then started to firm up some goals and noted that Sharma needed a post-tax return of 9% on his portfolio to achieve his financial goals listed below.

1) Sharma needs Rs 15 lakh for his sons under-graduate course, which he would be pursing in the US in November 2006.

2) He wants Rs 50 lakh by January 2012 to pay towards his daughters education.

3) He needs around Rs 15 lakh by December 2007 to pay off his personal loan.

4) Sharma wants to have a post-tax income of Rs 1,00,000 per month when he turns 60.

5) He wants to accumulate a corpus of Rs 1 crore for a Holiday Home in Ooty.

6) He wants to donate Rs 5 crore to build a hospital in his mothers name by 2018.

Note: Rakesh has options worth Rs 3 crore from his organisation, most of which are yet to be invested.

The above mentioned financial goals can easily be achieved with a simplistic portfolio having 40-50% in equity, 40% in debt and 10% in cash.

Sharma was a balanced investor but had exposed himself to additional risks by not giving due respect to his asset allocation and risk tolerance. He had not bothered to add debt to his portfolio besides the contribution made to the employees provident fund made every month.

Strategy

We then decided on the following:

1) We created an asset allocation to help him attain a long-term return of 9% to address his goals.

2) We then defined a money management approach for him on how to invest surplus money and how often to review the portfolio and make changes.

Sharmas current and recommended asset allocation are mentioned in the charts.

Sharma was recommended to focus on total return concept, wherein one can see the portfolio as an integrated whole, rather than as different parts. With a 50% exposure to debt and 40% exposure to equity, even if the equity portfolio corrects by 20% every year for 3 years, his overall returns would be a negative 5.5%.

Contingency planning & opportunistic cash

We kept 10% of his current cash holdings for contingencies. The funds can also be used to cash in opportunities such as benefitting from stock market gains. Though we are not proponents of market timing, we found opportunities to deploy some of these funds when the Sensex was at 9,000.

Risk management

A thorough analysis revealed that Sharma was short of life insurance cover by around Rs 3 crore, considered all goals including the holiday home and the donation to the hospital.

We decided that Sharma should opt for a cover of Rs 1.5 crore. The premium for this would be around Rs 80,000 per year.

He has sufficient comprehensive insurance covers for all other assets.

Investment strategy

1) We booked profits as well as losses on some of the funds and stocks, which had run up without any fundamentals to pay for his sons education and moved this into floating rate funds.

2) For short-term goals of less than 2 years, money would be invested in floating rate funds, fixed maturity plans and fixed deposits.

3) Mid-term investments would be made in balanced funds.

4) We created a long-term core portfolio of five equity mutual funds and 12 stocks. We looked at cross holdings between mutual funds and stocks and created a well-diversified portfolio across sectors, stocks, fund managers, investing styles and investment objectives.

5) We increased the debt exposure through fixed maturity plans, RBI bonds, Kisan Vikas Patras and National Savings Certificates etc.

6) We also devised a strategy and schedule to exercise the options as soon as they vest. We also ensured that no stock should form more than 10% of the portfolio.

Estate planning

1) We ensured that all investments had nominees and insurance policies were endorsed under the Married Womens Property Act.

2) We also created a will, detailing all investments, bank accounts, schedules of properties and identified an executor who respects Sharmas wishes.

3) We even created a power of attorney as Sharma travelled a lot and there were times when he was away for months.

The author is a full member of

Financial Planning Standards Board India. He may be reached at myplan@fpsbindia.org. The case study is only a model for educational purposes. For customised financial plan, kindly consult a financial planner.

To read the original article click here