Publication: DNA; Date: June 12, 2006; Section: Personal Finance; Page: 24

Publication: DNA; Date: June 12, 2006; Section: Personal Finance; Page: 24

For the stockmarket, the week from May 15 to May 22 was replete with such wild gyrations that there may be very few who escaped unscathed.

The talking point everywhere is, why did the Sensex go down? Where will it go next?

The second query, we all know, is an exercise in futility as no one can predict with certainty how things will go with the stockmarket barometer. I know of many wealthy clients who lost lakhs of rupees in just one day. The question I would like to ask them is, “Why get into such things in the first place? Is it really worth the trouble?

I asked the same questions to Ashwin Bhagat, who came to me very upset and angry because of the market fall.

“You had made so much money. Shouldnt you have followed the cardinal rule to protect what you had, and then to try your dabble in futures?

I told him how the guru of investment, Warren Buffet, called futures “the financial weapons of mass destruction”.

Bhagat was from the shipping industry and had created a huge corpus for himself (something that he could comfortably retire on, maintain his present lifestyle and pass on his wealth to his son, who, too, is well-settled).

He asked me, “Where do you think the Sensex is headed?”

I gave him an honest answer: “I dont know.”

He seemed more upset with me now.

I then asked him “Have you ever travelled by train?

“Yes,” he said, irritated.

“After you board a train, and five stations later, do you ask your fellow passengers where should you get down?”

“Of course not,” he replied.

“Then why do people do so when it comes to their investments?

They invariably call up a news channel or a broker and ask what should they do with a particular stock.

“The general principles of investing are always simple,” I said.

Bhagat understood what I was trying to say and asked me to help him.

We then discussed and firmed up some of his financial goals, which were:

1. A post-tax income of Rs1 lakh per month for the next 30 years.

2. Donating Rs 3 crore to philanthropic activities where he is actively involved

3. Investing Rs 1 crore in his sons business start-up.

4. Estate planning

5. Creating wills and trusts so that his estate will get divided between his son and the trust.

6. Insurance cover for his son.

After crunching the numbers and working out various options, we determined he needed around 4 % return to achieve all of his goals. But Bhagat wanted a return of 12%.

Strategy

We then did the following

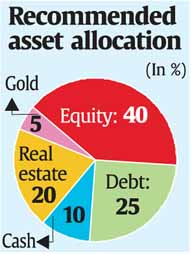

Created an asset allocation plan to help him attain a long-term return of 12% to address his goals.

We then defined a money management approach on how to invest surplus money and how often to review the portfolio and make changes.

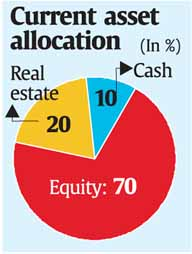

Bhagat had invested in 42 mutual funds and 103 shares. He was a balanced investor and felt that he could risk some part of his net worth to achieve a higher rate of return.

I asked him “Why 42 funds, 103 stocks and exposure to F&O? To achieve your expected rate of return, you do not need an army of funds, stocks and you certainly dont need to take exposure to futures.”

The current and the recommended asset allocation are given in the charts.

Contingency planning and opportunistic cash

We kept around 5-10% of Bhagats surplus in cash — some from a contingency planning perspective and most of it from an opportunistic cash perspective.

Risk management

nThe Bhagats had sufficient insurance and there was no need for additional insurance.

nThere was no need for any life insurance for his son as he had no dependents, no debt. Moreover, the son has a substantial corpus in his name.

Investment strategy

1) We reduced the mutual fund and stock portfolio to 9 and 15, respectively. We looked at cross-holdings between mutual funds, stocks and portfolio management service (PMS) and created a portfolio that was well-diversified across sectors, stocks, fund managers, investing styles and investment objectives.

2) We took a look at the stock of the PMS portfolio as well and realised that it was most hit due to very aggressive calls taken to earn higher returns.

After looking at short-term capital gains and losses, we rebalanced the portfolio and added blue-chip companies, equity diversified (large & mid cap) and balanced funds for the equity exposure.

3) We invested in some of fixed-maturity plans to benefit from double indexation to yield a post-tax return of 7% for 13 months.

4) We also invested in fixed income instruments like, Reserve Bank of India bonds, Kisan Vikas Patra and National Savings Certificates.

5) We are also looking at some investment in international real estate investment trusts and gold exchange traded funds for a maximum of $25,000.

I left Bhagat with a thought from Benjamin Graham, “Focus less on projection and focus more on protection (making sure that you do not lose much in case you are wrong).”

The writer has cleared the final module of the certified financial planner exam and runs his own financial planning outfit, My Financial Advisor. He can be reached at myplan@fpsbindia.org. The example used in the case is hypothetical.

To read the original article click here